ADVERTISEMENT

Ponzi Scheme

It is a fraudulent investment scheme that promises investors and customers high rates of return and low risk. This scheme generates returns for the old investors by attracting the new ones, and it is similar to the pyramid scheme in that both of these schemes are based on using the money of the new investors to pay the returns and profits to the previous investors.

However, both schemes fail in the end when the new investors stop joining the project, as this leads to the owners of the project not getting enough money to enable them to pay and distribute profits to the old investors, and thus the circle or chain on which the scheme was built stops. Ponzi puts all of its focus and energy into attracting new clients and investors to create its investments.

Charles Ponzi

The scheme was named after the well-known con artist Charles Ponzi, who started working on it in 1919.The Postal Service at that time developed international coupons that allowed senders to pre-purchase stamps and use them for correspondence.

The recipient takes the coupon to a local post office and exchanges it for the airmail stamps needed to send the reply. The constant fluctuation of postage stamp prices made them expensive in one country and cheap in another. Ponzi was hiring agents to buy cheap international coupons in other countries and then send them to him. He then exchanges these vouchers for stamps more expensive than the value of the vouchers purchased, as Charles Ponzi made a profit from selling these stamps.

Ponzi scheme rely on the constant influx of new investors to provide returns for the old ones. This type of trading is known as arbitrage, and it is an illegal practice, but Ponzi has become brave and expanded his efforts and business.

Ponzi was head of the stock exchange, promising investors and customers returns of 50% in 45 days and 100% in 90 days. Ponzi redistributed it and told the investors that they had made a big profit.

This scheme existed until 1920, when the Boston Newspaper began looking into the Stock Exchange.As a result of the newspaper’s investigation, Ponzi was arrested by federal authorities on August 12, 1920, and charged with several cases of mail fraud.

ADVERTISEMENT

Bernard Madoff

The implementation of the Ponzi scheme did not end in 1920 with the end of the story of its founder; as technology changed, so did the scheme. Bernard Madoff, a financial expert and consultant, was charged with participating in the Ponzi scheme in 2008.

His plan was to falsify trading reports to show that the client was making huge profits on investments that did not even exist. The similarities between Bernard’s plan and the Ponzi scheme lie in the following:

- Guaranteed promise of high returns and low risk.

- A continuous stream of returns regardless of market conditions.

- Investments not listed on the Stock Exchange (SEC).

- Investment strategies that are secret or difficult to describe because of their complexity

- Clients are not allowed to view their official investment papers.

- Clients face difficulties when trying to withdraw funds.

Bernard Madoff is the most well-known example of a Ponzi scheme in the United States of America.

One of the most important reasons for this is the people’s trust in him in the financial sector. He started his own investment project in 1960, and he helped launch the Nasdaq Stock Market.

Madoff’s fraud ended when his clients demanded $7 billion and he had only $200-300 million in his possession. Madoff admitted to his tricks and frauds, as well as stealing approximately $17.5 billion from investors who joined him in his projects; he is now serving a 150-year prison sentence.

The difference between a Ponzi scheme and a pyramid scheme

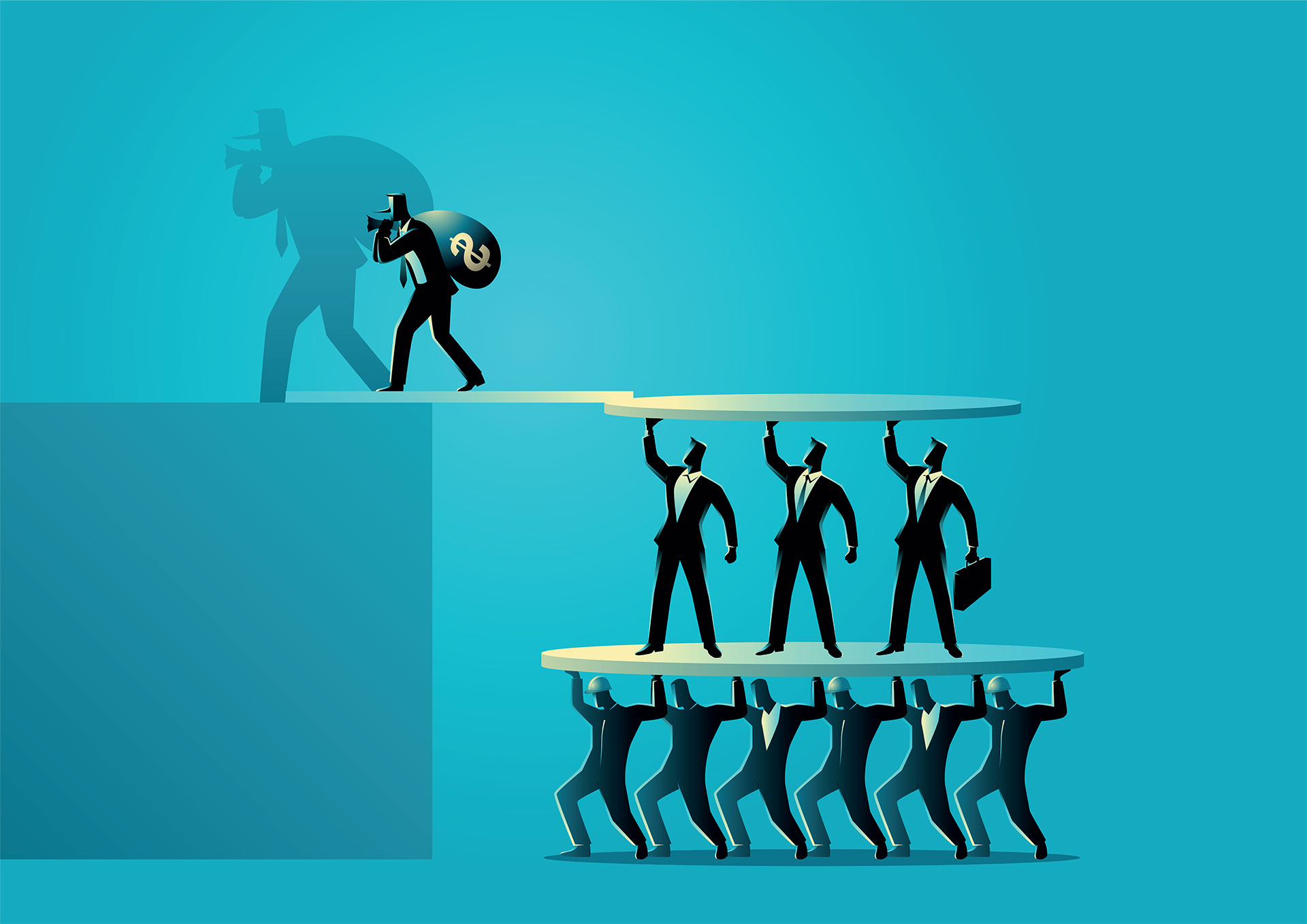

A Ponzi scheme is similar to a pyramid scheme in many characteristics, where the pyramid scheme can be defined as an illegal fraudulent investment scheme based on a hierarchy, and new affiliates to this scheme or investment project form the base of the pyramid; they provide the necessary funding, or the so-called returns, to be redistributed among affiliates or old investors who precede them in the hierarchy.

The pyramid scheme is not based on selling products or providing services but rather on the constant flow of funds from additional investors who join the investment project.

The main and obvious difference between the two schemes is that the investors in the pyramid scheme realize that they are making money as a result of joining new people, while the investors in the Ponzi scheme believe that they are making profits and returns from their investment.

Read also: Calculating the working capital turnover ratio