One of the most important decarbonization vectors, hydrogen has the ability to link and transform the existing fuel, chemicals, power, and gas markets.

Collaborations and alliances, which cut across corporate boundaries and industries and regions, are essential to the success of hydrogen initiatives. The Hydrogen Council and McKinsey statistics indicate that the estimated total investment needed across the hydrogen value chain through 2050 is between $7 and $8 trillion, with the hydrogen economy expected to generate roughly US$3 trillion in revenue by that time.

In order for Taiwan to achieve its goals in the rapidly developing hydrogen economy, it must first get past a major roadblock: a dearth of renewable energy sources, according to Olivier Letessier, president of Air Liquide’s Far East.

Involved in the hydrogen ecosystem as a global leader in industrial gases, Air Liquide uses cutting-edge technologies for the production, storage, and distribution of hydrogen. The administration of hydrogen stations in Japan and the use of cutting-edge electrolyzer technology in Canada are two examples.

Taiwan is adopting a more measured approach as it struggles to increase the generation of renewable power, in contrast to major players like China, South Korea, Japan, and others who have jumped ahead on hydrogen. The production of low-carbon hydrogen requires renewable energy in order for this to be successful and proceed to the next stage. Developing enough renewable energy is one of Taiwan’s challenges.”

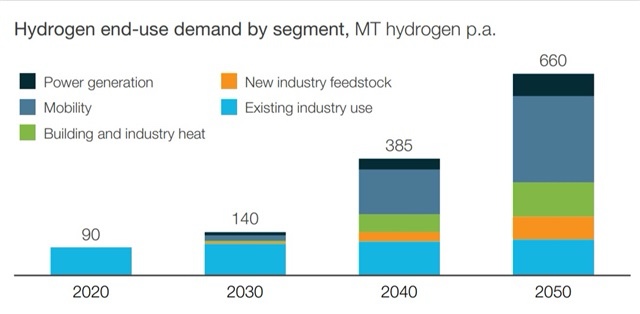

In a world with no net energy use, the need for clean hydrogen might amount to about 660 million metric tons (MT) by 2050, or 22% of the world’s total energy consumption. One promising green energy vector that could aid in the decarbonization of countries and industries is hydrogen.

Hydrogen that comes from renewable sources, such as solar or wind power, emits no direct carbon dioxide when burned or used in fuel cells. To develop hydrogen supply chains and technologies, major economies are spending billions of dollars.

Letessier claims Taiwan, a major producer of electronics and semiconductors, may be crucial to the hydrogen supply chain. Taiwan is in a good position to manufacture important hydrogen components like fuel cells, electrolyzers, and membranes because of its extensive experience in advanced manufacturing, according to him.

“Taiwan will become known as a top destination due to its manufacturing reputation and skills that have grown over the years,” Letessier predicted.

Taiwan has to figure out a way to increase the production of renewable energy from sources like offshore wind, though, before those opportunities can be grabbed. It will not be able to use that clean power to electrolyze low-carbon “green” hydrogen until then.

Letessier pointed out that rather than using private automobiles, some promising transportation use cases might make use of heavily used commercial fleets like trucks and taxis. Reforms to Taiwanese regulations may also be necessary, as the current cap on hydrogen storage is set at 200 bar of pressure, which is insufficient for long-term mobility.

Similar to previous energy transitions, collaboration between the government and business will also be crucial, according to Letessier. Taxes on carbon emissions and subsidies for hydrogen investments are examples of potential policy levers that could raise the cost-competitiveness of alternative fuels.

Taiwan’s ambitions to become a hydrogen-powered nation depend heavily on renewable energy, which accounts for less than 10% of the country’s power mix at the moment.