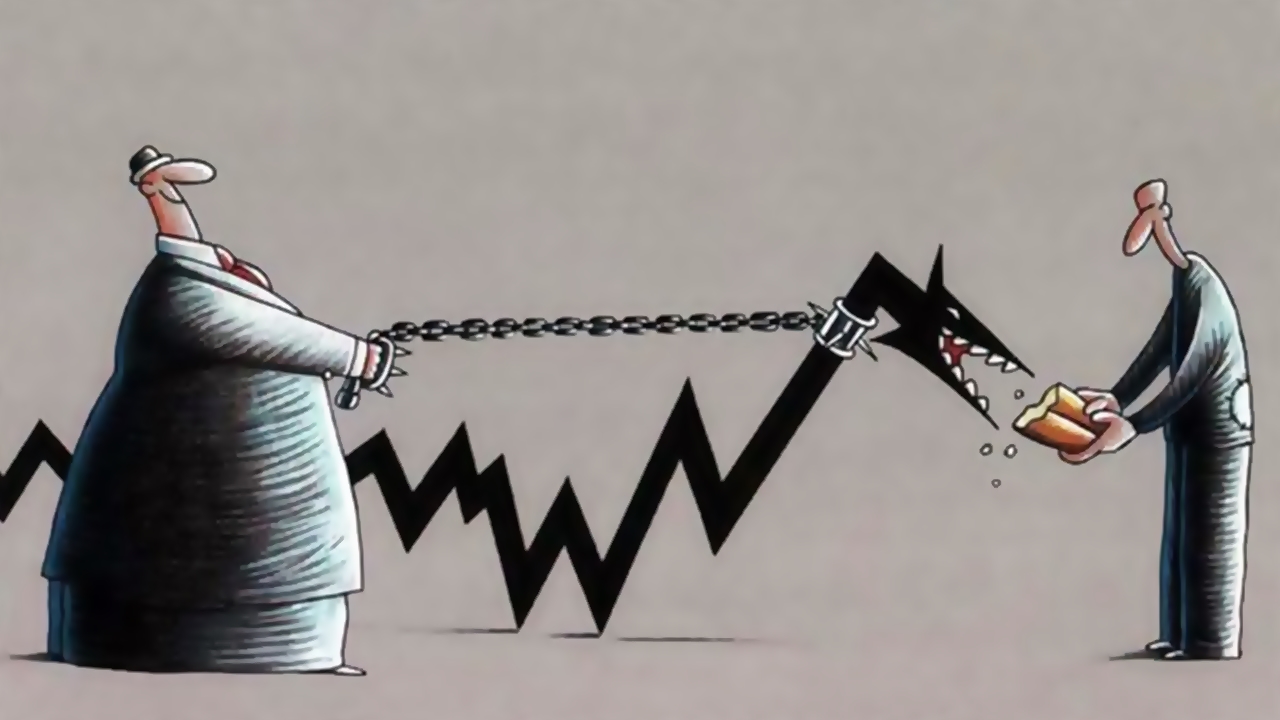

Concept of debt

The creditor – Debt is defined as any person borrowing money or goods from another person, and that is by agreement and consent between them, provided that the money is paid or the goods are returned within the period agreed upon by the two parties, and debt can help or harm your financial life and depends on that. To be more clear, debt can be defined as the amount of money that an entity, person, company, organization, or government owes to another entity.

What is the difference between a creditor and a debtor?

The creditor and the debtor are two different parties to the debt process, and there are many differences between them, as follows:

Conceptually

A creditor is defined as a person, institution, or any entity that provides credit by giving the other party permission to borrow money that is agreed to be repaid in the future, while the debtor is defined as an individual, company, or any entity that borrows money.

In terms of creditor and debtor forms

Creditors and debtors can be individuals or companies, and mostly companies and individuals are debtors who borrow money from banks and other financial institutions. As for creditors, they can be individuals or companies and are often seen as banks.

In terms of the nature of the accounts

The basic accounts in accounting can be divided according to the nature of the accounts into two parts:

- Debit accounts: such as accounts of assets, expenses, and personal withdrawals—are recorded in the debit party in case of an increase, but in case of a decrease, they are recorded in the credit party.

- Credit accounts: such as obligations, revenues, and capital, are recorded on the credit side of the entry in cases of increase, but in cases of decrease, they are recorded on the debit side.

In terms of financial movements

Most of the accounts can be recorded in the debtor party or in the creditor party, depending on their movement; for example, assets are recorded in the creditor party in case of a decrease, and obligations are recorded in the debtor party in case of a decrease.

In terms of legal accountability

The creditor may sue the debtor on the issue of his inability to pay his debts, and it must be noted that if the creditor is a bank, he can recover the value of the debt with equivalent guarantees such as houses, real estate, or cars.

In terms of legal protection

The FDCPA provides legal protection for debtors by specifying when, how often, and where to contact them, guarantees the privacy and rights of debtors, and applies to third-party debt collection agencies.

In terms of declaring bankruptcy

In the event that the debtor declares bankruptcy, the court informs the creditors of the procedures. In some cases of bankruptcy, all the assets of the debtor are sold in order to pay off the debts, and then the bankruptcy trustee pays the debts in order according to their priorities.

Read also: Reasons that contribute to economic growth?