The government budget is defined as a summary of the financial documents that relate to the main financial facts about what the government expects in terms of expenditures and revenues during a specific period of time. The budget includes information that breaks down revenues and expenditures into specific categories, and the government budget often requires legislative approval.

What are the types of government budget?

The government budget varies into three types, which are the balanced budget, the surplus budget, and the deficit budget, and the following is a description of them:

BALANCED BUDGET

This type of budget is represented by this equation: R = E; that is, when the government’s revenues are equal to its expenditures and the government’s fiscal discipline appears.

Although a balanced budget shows the ideal approach to achieving a balanced economy and maintaining fiscal discipline, it does not guarantee financial stability in times of economic depression or recession.

Advantages of a balanced budget

- Ensure economic stability if implemented successfully.

- Ensure that the government refrains from improper spending.

Cons of a balanced budget

- Not sustainable in times of recession.

- It does not provide any solution to economic problems such as unemployment.

- Not applicable in less developed countries as they limit the scope for economic growth.

- The government restricts public welfare spending.

SURPLUS BUDGET

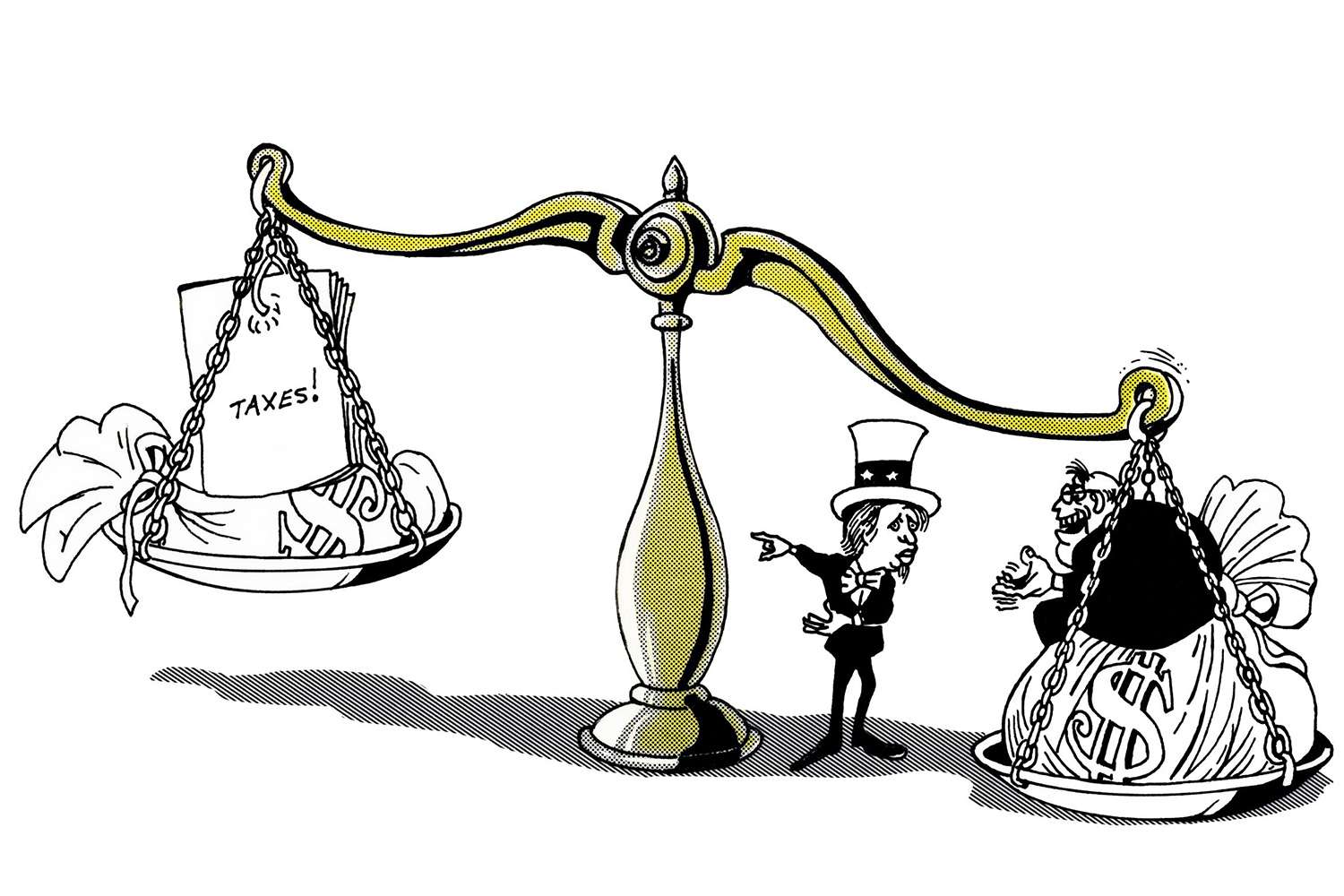

This type of budget is represented by this equation: R >E); that is, when government revenues and profits from taxes imposed are greater than the amount spent by the government on public welfare. Expenditure and the budget surplus are used to reduce the government’s public debt or increase savings, and the budget surplus refers to the country’s financial wealth, and such a budget can be implemented in times of inflation to reduce aggregate demand.

Advantages of a Surplus Budget

- Solving economic problems, especially in times of inflation.

- Create additional financial reserves.

- Reduce outstanding loans and the burden of interest and debt.

Disadvantages of a surplus budget

- Deflation.

- Negative impact on consumer behavior.

- Damage to businesses and investments.

- Slow down the economy.

DEFICIT BUDGET

This type of budget is represented by this equation (R < E); that is, when the government’s revenues are less than its expenditures, the government covers the fiscal deficit through public borrowing by issuing government bonds or by withdrawing from the surplus reserves, and the economy of this type of budget represents the economy of developing countries.

Positives of the helpless budget

- Solving economic problems, especially in times of recession and unemployment.

- Generate additional demand.

- Promote the rate of economic growth.

- Increase in demand for goods and services.

- Revive the economy.

Disadvantages of a deficit budget

- It encourages improper spending by the government.

- Increasing the financial burden on the government through the accumulation of debt.

Read also: The difference between financial management in private and public