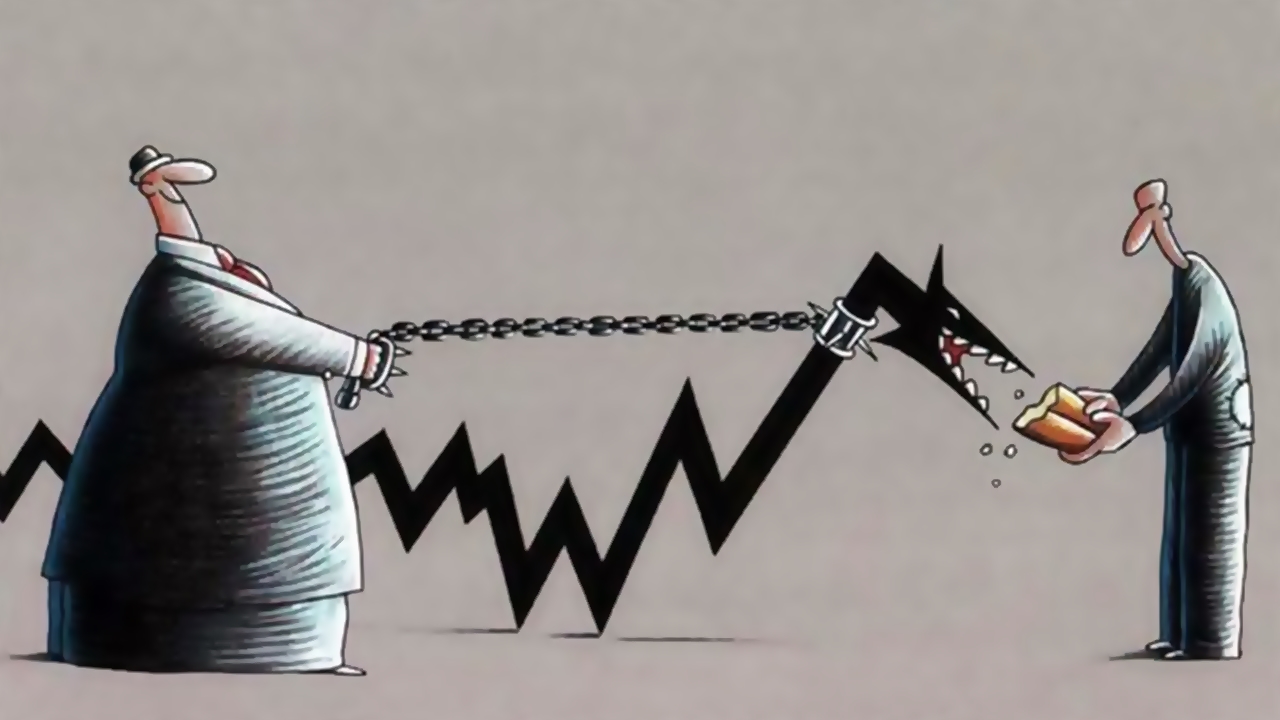

Inflation refers to a rise in prices to an undesirable level due to the continuity of this rise in the general level of prices. With this, the purchasing power of the local currency decreases, and the cost of acquiring anything becomes more expensive than it was before.

This is not to say that all inflation is disliked or undesirable, but rather that there is a need for some inflation to ensure the flow of money between producers and consumers, and a lot of inflation ravages the economy and reduces the purchasing power of individuals, while the other direction of inflation, or negative inflation, leads us to stagnation, which is another economic problem.

In general, we need to know inflation levels to help direct our future financial decisions. There are many indicators of inflation by which we infer inflation, and its amount will be discussed in this article.

What are the most popular indicators of inflation?

There are many indicators that infer inflation; the following are the most famous of these indicators:

Consumer price index CPI

It is the most common and most used indicator for tracking and calculating inflation. This indicator calculates the changes that occur in prices for the daily needs that consumers spend on a daily basis. These needs include a wide basket of goods and services in large numbers. This indicator contains more information because it includes the CPI-index.U, which is a broader indicator in calculating the change in goods and services, in addition to the CPI-W index, which is a more specialized indicator as it means measuring prices that affect hourly wages for workers in urban areas. In general, this indicator and its branches are based on measuring the change in commodity prices based on the difference between prices between the current year and the previous year, or a predetermined fixed year called the base year.

Producer price index PPI

It is an opposite indicator to the previous indicator in the calculation, which measures the consumer price index, the change in the prices of commodities paid by individual consumers. As for this indicator, it measures the rate of change in the prices that producers acquire for their products. This indicator measures the rate of change in the prices of a wide range of produced commodities in different sectors, industries, or product categories.

Employment Cost Index ECI

It is an indicator that measures the change in prices of operating costs or labor costs, their compensation, and the benefits enjoyed by employees. It is a very accurate indicator that measures the smallest details in order to identify positive and negative changes in labor costs, giving a more accurate description of wage inflation.

Gross domestic product price deflator GDP

This indicator is concerned with measuring changes in the prices of produced goods intended for domestic and foreign use. It measures inflation based on knowing the average change in the market value of a wide range of final goods and services provided during a certain period of time. The goods included in calculating inflation according to this indicator change every year so that it enters another group of commodities, so it is a commonly used method.

Read also: The main reasons for the increase in inflation