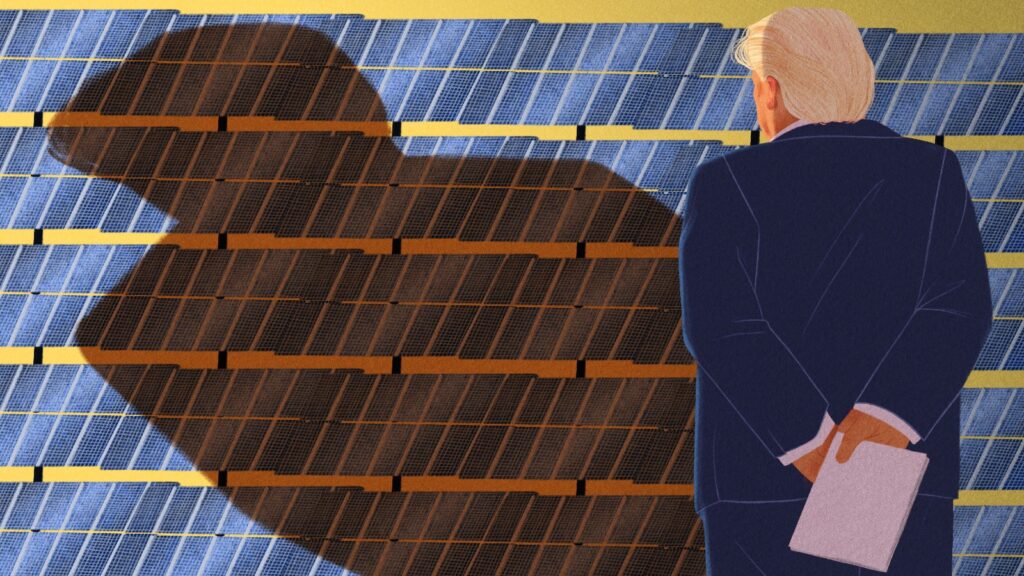

The Impact of the 2024 U.S. Presidential Election on the Renewable Energy Industry

Trump Surge Under the Previous Administration

Nearly 33% of the 148GW installed capacity of onshore wind power in the United States was put into service between 2017 and 2020. 48GW was installed or repowered in total during that time, as opposed to 42.2GW between 2021 and 2024—which included the estimated 11.4GW predicted by IntelStor to be used through the end of 2024.

The reason for the increased use of renewable energy under Trump was that many projects had already been approved during the second term of President Obama; it simply took longer for Trump to implement the approved capacity. Additionally, during the majority of Trump’s presidency, interest rates were lower, which encouraged oil and gas companies to invest heavily in solar and offshore wind energy, among other renewable energy sources.

The Shift Under Biden’s Presidency

During Biden’s presidency, there has been a greater increase in the use of solar and battery storage, in part because of the electricity market trading and energy arbitrage that batteries provide. In addition, during the previous three years, increased adoption was made possible by the drop in battery unit costs brought about by economies of scale.

Further cost reductions have also benefited solar in recent years, but more hybrid or distributed generation projects are being built as a result of overflowing interconnection queues. As a result, some solar capacity was removed from grid tie-in; additionally, because the projects were smaller in scope than utility-scale development projects, funding was more easily obtained.

Biden Slowdown and the Inflation Reduction Act

Biden’s term has also seen a marked decrease in onshore wind capacity additions due to the post-COVID-19 spike in inflation. The hikes in interest rates, which were required to combat inflation, also turned off investors who were getting better returns from oil and gas investments than from wind, solar, or storage projects.

The Inflation Reduction Act (IRA) was implemented by the Biden administration, but its full effects are still being felt by the industry. The majority of the factories will be constructed later this year or well into the next President’s term, so the manufacturing tax credits are only now beginning to be distributed.

The Role of Offshore Wind Regulation

As instructed by the White House, the lead offshore wind regulator, the Bureau of Ocean Energy Management (BOEM), is already working quickly to approve as many projects as possible before Biden’s term ends. They were acting in this manner regardless of his candidacy or the election’s result. Since Harris has less ties to the oil and gas industry than President Biden does, the trend of project consents is likely to continue and possibly pick up steam if Harris wins the election.

Finance Factors and the Impact of Interest Rates

The US offshore wind industry’s prospects are actually more dependent on interest rates than on the president in any case. The technology is tried-and-true and economical, especially in an environment with lower interest rates. If they could secure better financing than what is available with today’s interest rates, more businesses—including those in the oil and gas industry, which recently pulled out of renewable energy investments—would be willing to put money back into these projects.

Potential Impacts of a Trump or Harris Administration

With its appointees leading the US Federal Reserve, a Harris administration is likely to maintain a gradual reduction in interest rates, which would present ongoing difficulties for the industry. The rate of capacity additions would inevitably slow down if there were higher project permitting rates coupled with less capital available at favorable interest rates to build projects.

If Trump wins, the Federal Reserve will presumably install a new chairman—a woman or man—who will be more obedient and inclined to cut interest rates more quickly. Any wind, solar, or storage projects that had already received approval before the January 2025 inauguration would profit from broader access to less expensive capital in the first few months of 2026.

However, a Trump administration might harm the industry by refusing to approve permits for projects that are still in the early stages of development. Furthermore, there is a good chance that a Trump administration will impose further import taxes on European, Chinese, or even Indian components that are used by domestic wind, solar, or battery storage OEMs.