NextEra Energy has recently issued Series U Junior Subordinated Debentures worth $875 million, enhancing its financial position with long-term maturity and favorable interest rates. This move comes as the S&P 500 continues its winning streak, reflecting broader positive market trends. Despite a decline in net income, NextEra’s strategic capital raise has helped stabilize its position, contributing to a 10% price increase last month.

The issuance of these debentures injects significant resilience into NextEra Energy’s finances, especially as the company navigates the evolving economic landscape. While the broader market has seen gains, NextEra’s recent performance contrasts, underscoring the importance of this capital boost. The funds provide a critical buffer and could enable the company to pursue renewable energy projects that align with global decarbonization goals and U.S. electrification trends.

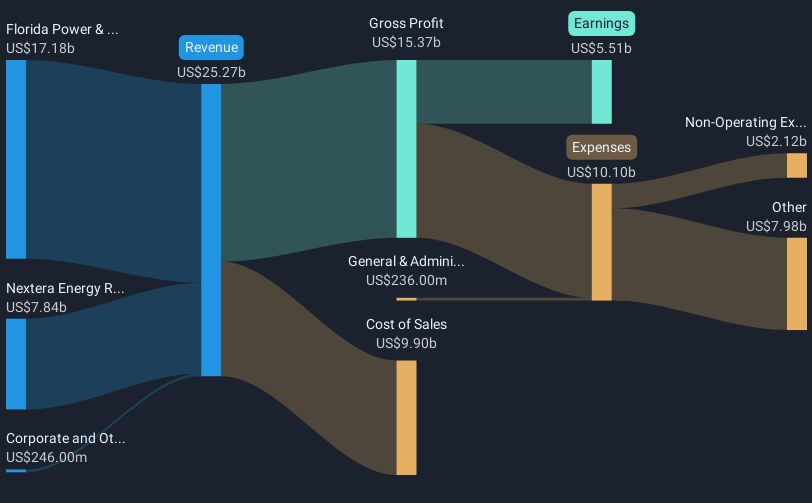

NextEra Energy’s strengths lie in its scale and cost efficiency, making it well-positioned to capitalize on the growing demand for renewable energy. The fresh capital from the debenture issuance could enhance the company’s ability to invest in new projects, which may not only increase revenue growth prospects but also improve profit margins as more electricity generation initiatives come online.

Over the past five years, NextEra has delivered a total shareholder return of 46.96%, showcasing robust growth in rapidly evolving energy sectors. However, the last year has seen the company underperforming the U.S. Electric Utilities industry, which grew by 11.8%. This highlights the importance of strategic investments moving forward.

The recent capital raise adds flexibility for NextEra in terms of investments, potentially accelerating growth beyond current forecasts. As the company continues to focus on expanding its renewable infrastructure, these investments could drive revenue and earnings, possibly exceeding consensus expectations.

NextEra’s share price currently sits at $66.54, reflecting a moderate discount to the consensus analyst price target of $81.86, with some analysts projecting prices as high as $103. Although the company has faced short-term challenges relative to the market, leveraging fresh capital for strategic initiatives could support a future valuation re-rating as it seizes emerging electrification opportunities.

NextEra Energy’s issuance of $875 million in junior subordinated debentures marks a significant step in reinforcing its financial position. As the company aims to expand its renewable energy projects, this capital raise could play a crucial role in driving future growth. With a focus on strategic investments, NextEra is well-positioned to adapt to market changes and capitalize on the growing demand for sustainable energy solutions.