Credit sales are purchases in which payment is delayed by customers, the use of credit sales is a key competitive tool in some industries, where certain payment terms can be used to attract additional customers, in other words, credit sales refers to a sale in which ownership is goods and services is transferred to a customer who pays the amount due at a later date of the purchase.

Why credit sales?

The sales account is a credit account because it proves the company’s sales account; in the case of a cash sale, an entry is prepared from the cash account to the sales account, and for sales of the account to the customer, the transaction is made from the customer’s account to the sales account. Performing the transfer process from the bank account to the customer’s account, the sales account is used in order to maintain the proceeds of sales made during the financial year, but upon completion of the financial year the credit balance will be transferred by closing the entries to the company’s retained earnings account (equity account Property).

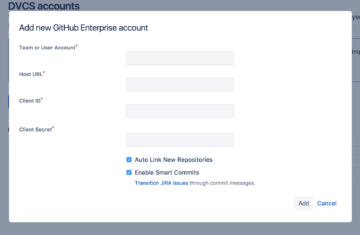

Illustrative example

Company A decides to sell new computers worth $20,000 to Company B on the account, if the debit party (+) increases the assets and the credit party (-) increases the sales, and the method of entry is as follows:

From / accounts receivable 20,000

to / sales 20,000

How to manage credit sales efficiently

There are four ways to increase the efficiency of credit sales, including the following:

Billing receivables management

By tracking each sales invoice and mapping it with subsequent receipts received from the customer, it is possible to easily track the pending invoices at any time instead of just knowing the invoices due from customers.

Date analysis

The longer the invoice period as accounts receivable, the more this will lead to cash flow problems and, at some point in time it may turn into bad debts. Therefore, it is important to specify the date at the top of each invoice, in order to identify long-outstanding invoices, and those that require immediate action.

Periodic follow-up of payment performance

Customer payment performance is defined as the average time it takes for customers to actually pay their bills regardless of the balance due on the statement date, to identify customers based on business history.

Internal control techniques

To ensure the credit balance is better managed, the maximum credit balance can be determined based on the credibility, transaction volume, payment capacity, etc. of your customers, This helps business owners increase sales, so the process of automating the accounts receivable is done using accounting software. Accounting software for businesses makes it easy to manage receivables, track outstanding invoices, and create real-time billing of receivables.

Read also: What You Should Know About Balance Sheet List