GE Vernova’s wind division has reported a significant reduction in its EBITDA loss for the first quarter of 2025, narrowing it to $146 million compared to $173 million in the same period last year. The division achieved a 15% increase in revenue, totaling $1.8 billion, primarily due to higher onshore wind volumes and improved pricing strategies.

The segment’s profit margin improved to -7.9%, up from -10.6% in Q1 2024. This enhancement was driven by effective product cost reductions, growth in service offerings, and better price realization, as detailed in the company’s investor presentation. Despite these gains, orders fell sharply by 43% year-on-year, dropping to $640 million. This decline is attributed to a dynamic policy environment and project delays within the US market.

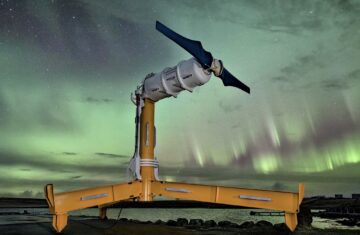

While GE Vernova noted that pricing and margins for onshore projects remained robust, pressure on margins for offshore projects persisted as the company continued to execute legacy contracts. This mixed performance reflects broader industry challenges, including fluctuating government policies and supply chain disruptions that have affected many renewable energy companies.

At the group level, GE Vernova reported a net income of $300 million for Q1 2025, marking a $400 million increase from the same quarter last year. The company also achieved an 11% rise in revenue, reaching $8 billion, or a 15% increase on an organic basis. This growth was driven by a notable 16% increase in services and a 43% surge in power equipment sales.

GE Vernova reported an adjusted EBITDA of $500 million, translating to a margin of 5.7%. The company generated $1 billion in free cash flow during the quarter, a critical milestone for its operations. CEO Scott Strazik highlighted these results, stating, “We delivered strong results in the first quarter and our businesses continued to execute well. Our lean culture is enabling us to deliver on accelerating global electricity demand.”

CFO Ken Parks emphasized the importance of positive cash flow, noting, “We executed on our commitment to return cash to shareholders through our share repurchase actions and inaugural dividend payment.” The company reiterated its guidance for 2025, targeting revenues between $36 billion and $37 billion, an adjusted EBITDA margin in the high-single digits, and free cash flow of $2 billion to $2.5 billion.

Despite challenges posed by tariffs and inflation—estimated to impact results by $300 million to $400 million—GE Vernova remains optimistic about its growth trajectory. The company’s focus on enhancing its operational efficiency and expanding its service offerings positions it well to capitalize on the increasing demand for renewable energy solutions.

GE Vernova’s financial performance in the first quarter of 2025 reflects a resilient response to industry challenges, with improvements in revenue and margin performance. As the company continues to navigate the evolving energy landscape, its commitment to innovation and shareholder value remains a key priority.